Mobile banking

Today, almost a complete list of the most common banking services can be obtained from a tablet or smartphone via a mobile application or instant messenger. This is due to the intensive development of smartphones. With each new generation, they are becoming more comfortable and versatile, and we, in turn, spend more and more time in them and always keep handy.

So, by itself, the idea arose to integrate into the smartphone also the full-fledged management of its own finances. Such remote banking began to be called "mobile". It is simple, convenient, allows customers to save time and not be tied to a specific place. Moreover – it is very actively developing.

So, by itself, the idea arose to integrate into the smartphone also the full-fledged management of its own finances. Such remote banking began to be called "mobile". It is simple, convenient, allows customers to save time and not be tied to a specific place. Moreover – it is very actively developing.

Thus, mobile banking applications have become one of the most common among Americans. According to last year's research of the Citigroup Inc. financial corporation (1), ), from 2000 respondents, 31% actively use mobile banking applications, it is second only to social networking (55%) and viewing the weather forecast (33%).

1 - https://www.prnewswire.com

Bank in the messenger

According to the experts, instant messengers are the most dynamic way of interactive communication. It is predicted that in the nearest future they will surpass even the social network in popularity. In accordance with the statistics from the DigData marketing research agency, 67% of our compatriots spend up to 1 hour a day communicating in instant messengers, 24% spend about 3 hours. And if we consider that recently the number of smartphone users has increased up to 85% in Ukraine, it is not surprising that Ukrainian banks have been actively thinking about how to integrate their services quickly into messengers.

What are the advantages of banking in a messenger?

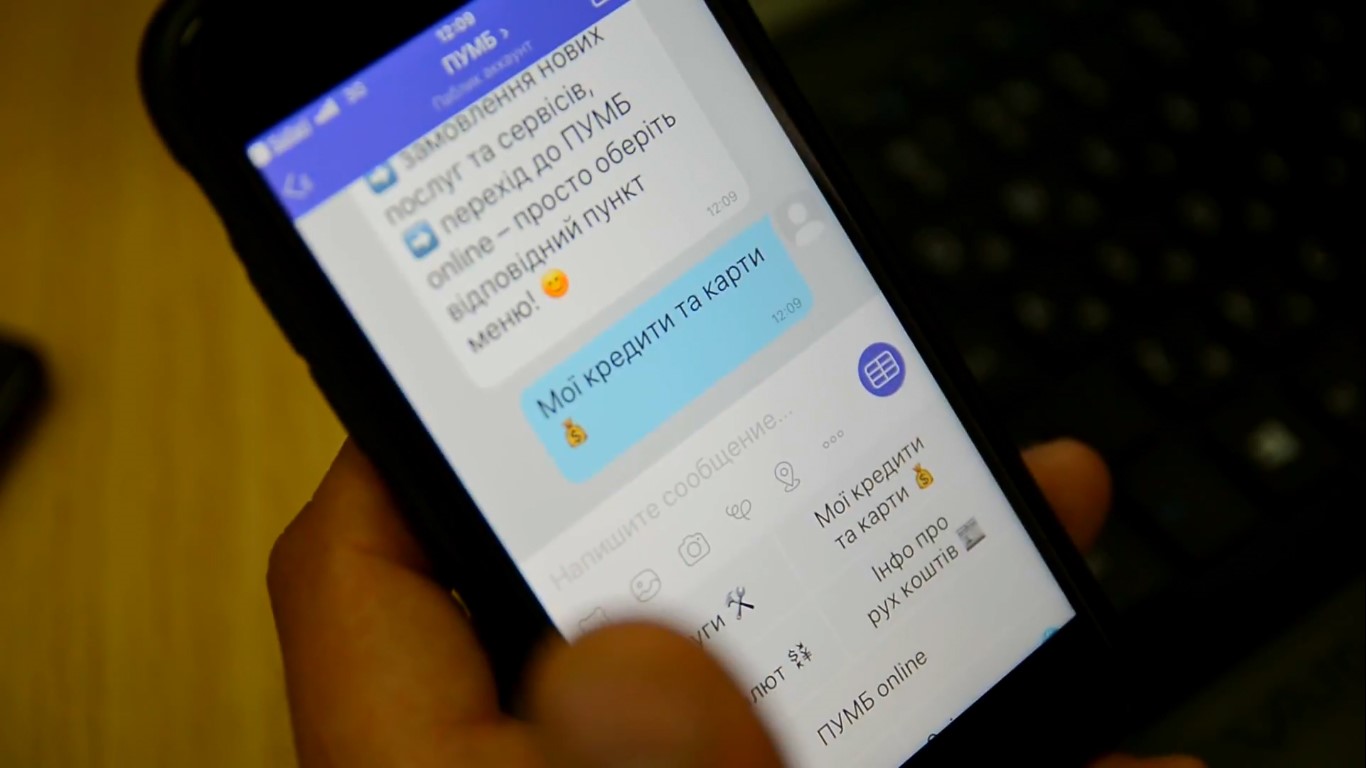

First of all, it is very convenient, because a large number of financial services can be obtained through ordinary correspondence. No need to call the bank's hotline or use the feedback service. In this case, all operations can be performed very quickly. For example, a customer of PUMB, a financial institution, which the first in Ukraine presented full-fledged banking in the Telegram and Viber messengers, can get the necessary information around the clock for a few seconds. For example, find out the amount of the next loan payment, arrears, full repayment of the loan and the like.

And with the help of banking in the messenger, PUMB customers are able to issue an electronic insurance policy for cars, find out the current exchange rate, top up the phone, send an application for a loan or credit card, check the flow of funds in the account and much more.

The number of users of PUMB services in chat bots is constantly growing.

According to the experts, banking in a messenger will become increasingly popular. Already, in some countries of Europe and the USA, by sending a message via an instant messenger, you are able to pay for public transportation, a bill in a cafe, pay for purchases in a store. These new opportunities will certainly come to Ukraine!

Bank in the mobile application

In the new version of “PUMB Online” mobile application , the main functions are implemented that allow you to manage your finances independently anywhere in the world. You are able to view the information on registered products at any time, find out the amount of the monthly payment and the full amount of debts on loans and credit cards, view the history of operations, top up your mobile without a fee, replenish or withdraw funds from an existing deposit, open “Vilniy Online” deposit, make all types of payments and transfers. Changes in the new application are implemented monthly.

In the new version of “PUMB Online” mobile application , the main functions are implemented that allow you to manage your finances independently anywhere in the world. You are able to view the information on registered products at any time, find out the amount of the monthly payment and the full amount of debts on loans and credit cards, view the history of operations, top up your mobile without a fee, replenish or withdraw funds from an existing deposit, open “Vilniy Online” deposit, make all types of payments and transfers. Changes in the new application are implemented monthly.

Narodniy bankir

So, the new features have appeared in PUMB Online mobile app recently:

- add all your cards of other banks for the convenience of transfers;

- repay monthly payments on loans from a card of another bank without a fee;

- restore the password for access to “PUMB Online”system;

- manage service settings from the application;

- activate/cancel your own Touch ID or Face ID;

- create and replace your application PIN.

In addition, in early March, customers will be able to create and manage their own transfer templates.

Only three months after the introduction of the new mobile application, more than 270,000 customers downloaded it. By the way, this can be done from your smartphone via the links pumb.ua/ios or pumb.ua/android.

Thanks to the new version of “PUMB Online” application you can freely make transfers directly from your smartphone.

Interesting to know

How old is virtual banking service?

You are mistaken if you think that 3-4. All 24! The first systems that allowed remote viewing of bank accounts appeared in the United States as early as 1981 – they were called At-Home Banking. Later, with the development of Internet technologies, systems with elements of online banking have evolved somewhat more actively. In 1995, the first virtual bank in the world, Security First Network Bank, appeared in the USA, which offered users to make full use of the communication and service capabilities of the Internet. In fact, it did not receive mass distribution because of the total distrust of potential customers to electronic technologies. However, the evolution of virtual solutions began, and nothing could stop it.

- TEST: How knowledgeable are you about security issues?

- Non-pattern deposit: How to work mindfully with deposits through meditation

- Deposit agreement: let's read together

- Opening an account in FUIB using "Diia" in 5 minutes

- Sergei Zubov: "Stability in the market, loyalty to the customer, efficiency in decision-making are the three components of your bank."

- ТОП-3 ШАХРАЙСЬКИХ СХЕМ

Отримати на e-mail

Новину відправлено

Перевірте e-mail Дякуємо за Вашу цікавість!

questions

complaint or suggestion

networks

Feedback