-

Information for shareholders and stakeholders

- JSC "FUIB" Charter

- Licenses

- Bank’s ownership structure

- Corporate Governance Code

- General meeting of shareholders

- Supervisory Board

- Management Board

- Regulated information of the issuer

- Reporting on the remuneration of influential individuals

- Compliance and corporate ethics

- Risk management

- Internal Audit Department

- Organizational structure of the Bank

- Press-center

- Appeal and safety

- Financial reports

- Financial Institutions

- Investor relations

- Sustainable development

-

Supplemental information

- Awards and achievements

- The partners in lending

- Credit intermediaries

- Commercial rate

- IBAN standard in Ukraine

- Correspondent Banks

- Membership directory

- Insurance conditions and insurance partners

- The information for parties related

- Information on trademarks (TM)

- Settlement of overdue debts and the protected category of persons

- Тимчасовий захист осіб в ЄС

- General principles of confidentiality and protection of personal data

- General principles of compliance risks monitoring

- General principles of data updating (re-identification)

- Maintenance work

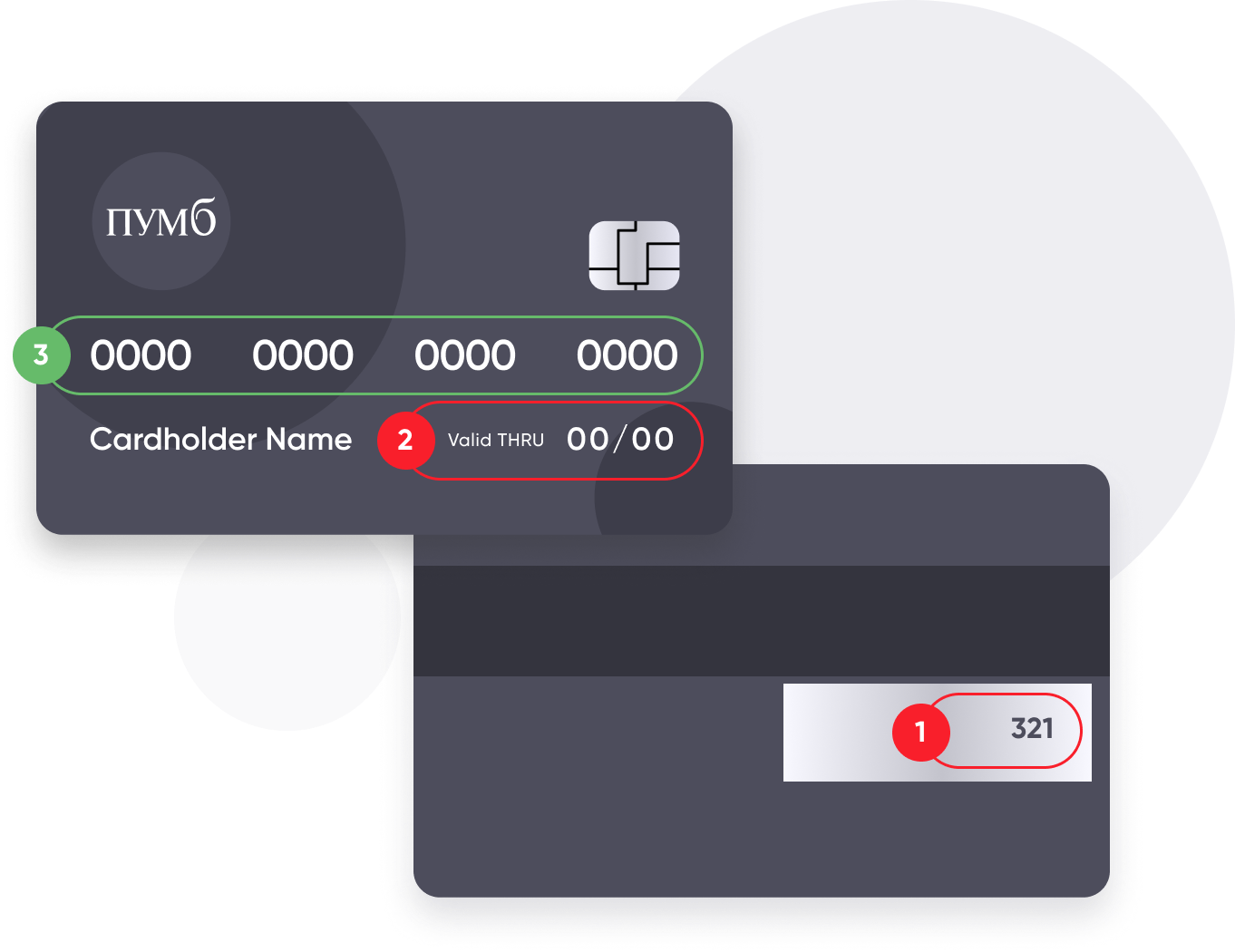

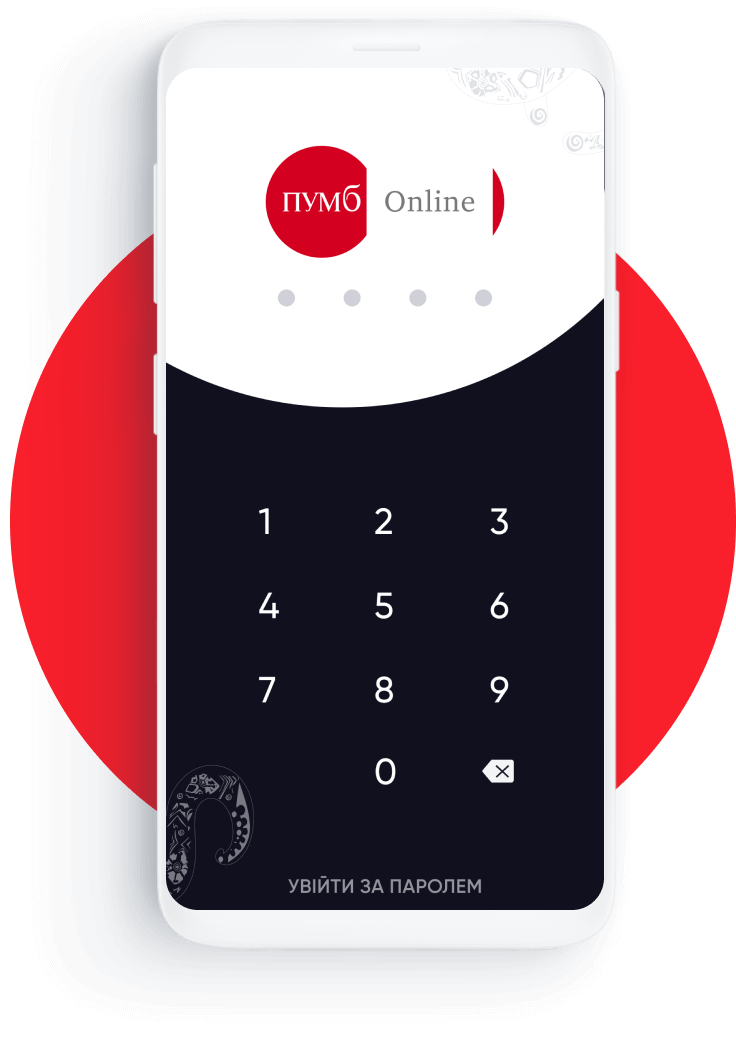

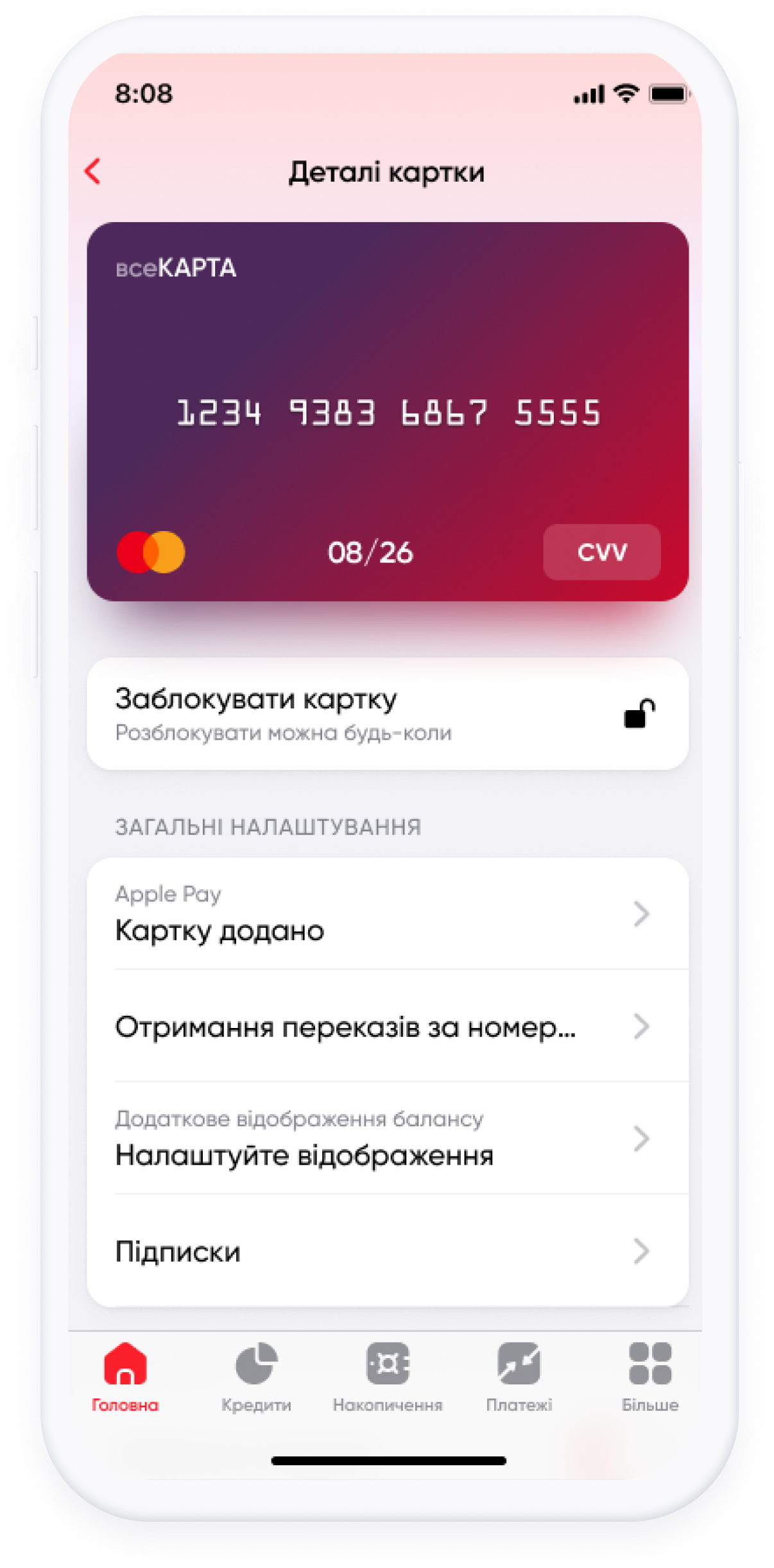

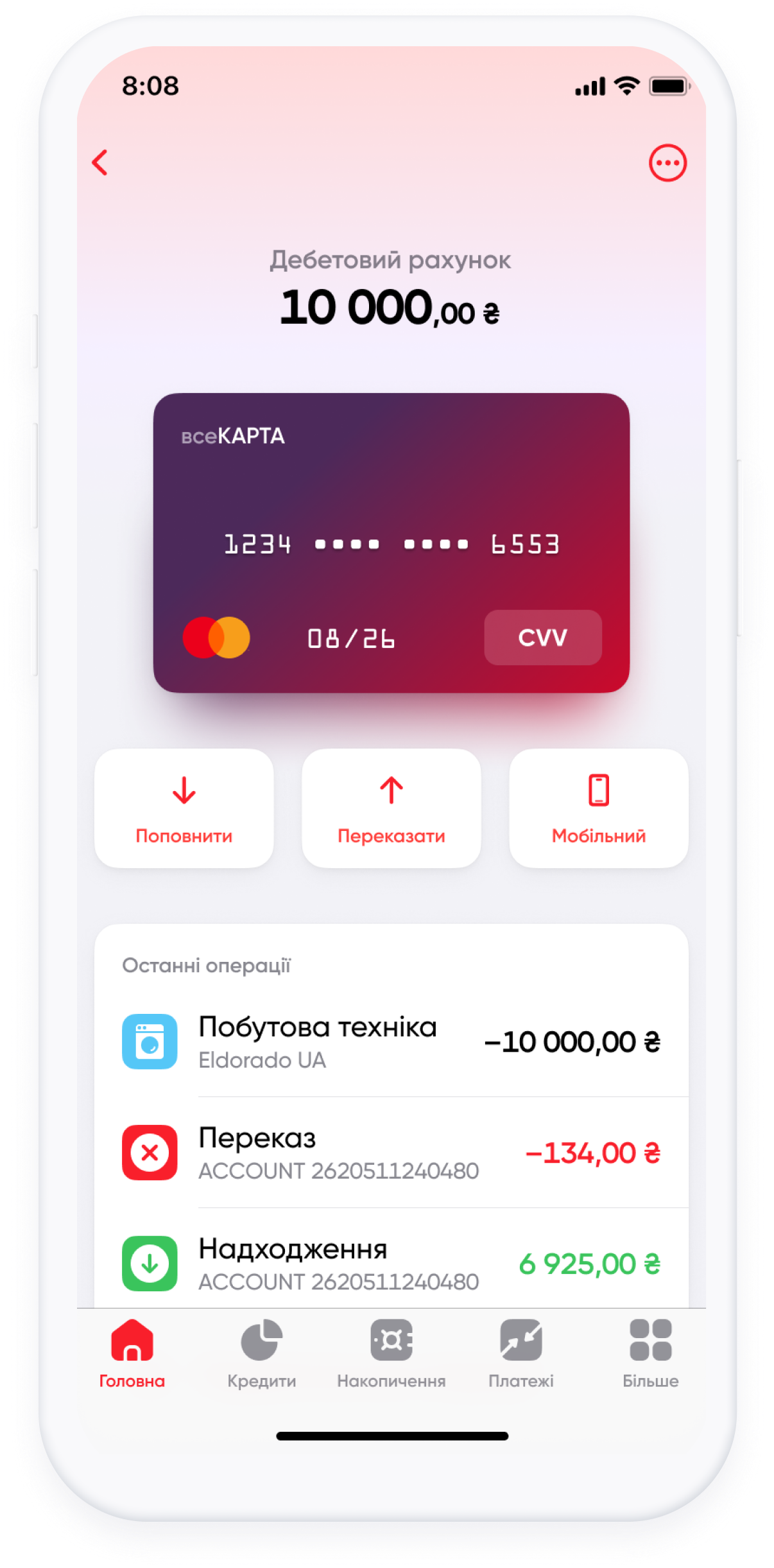

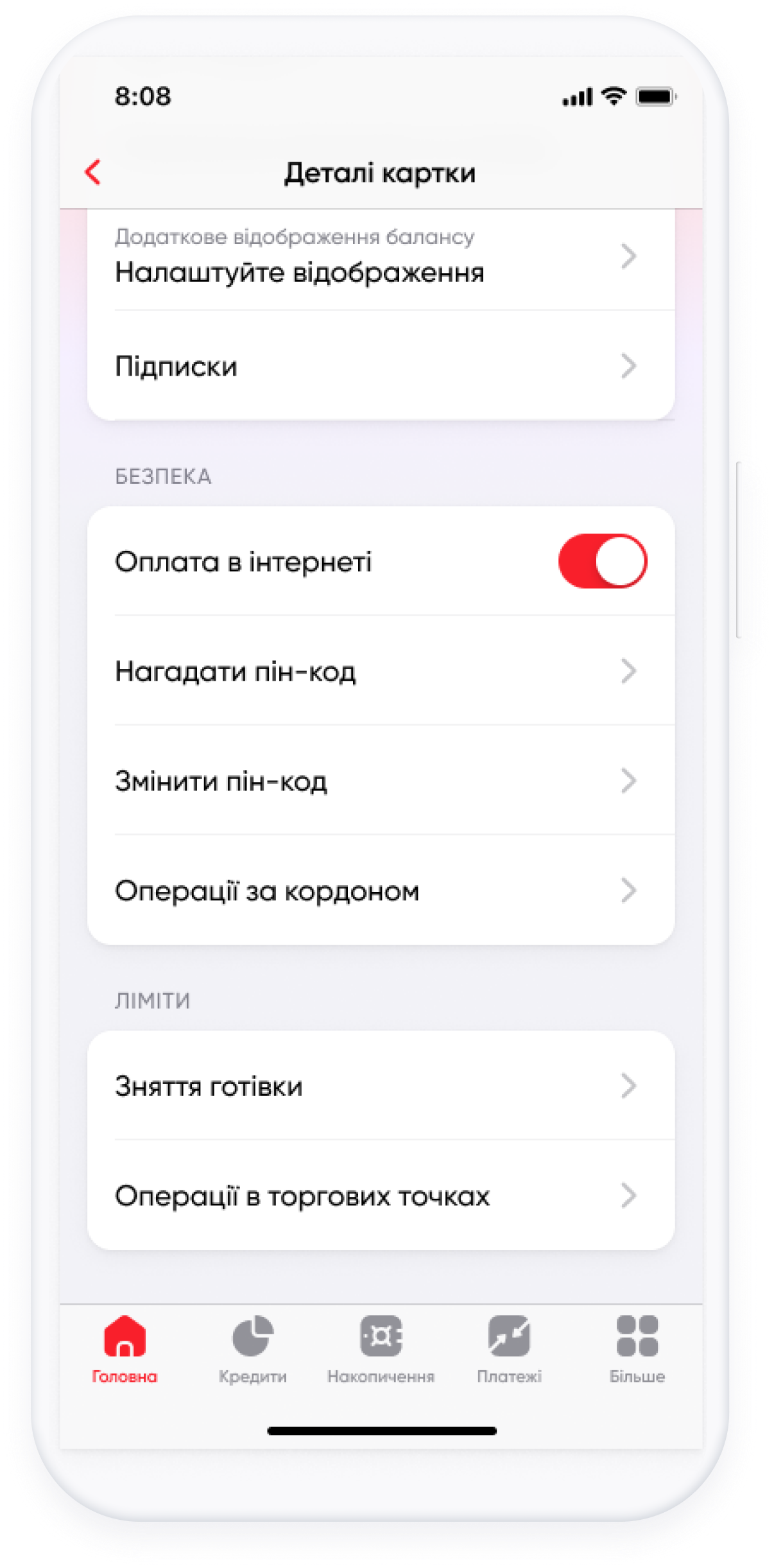

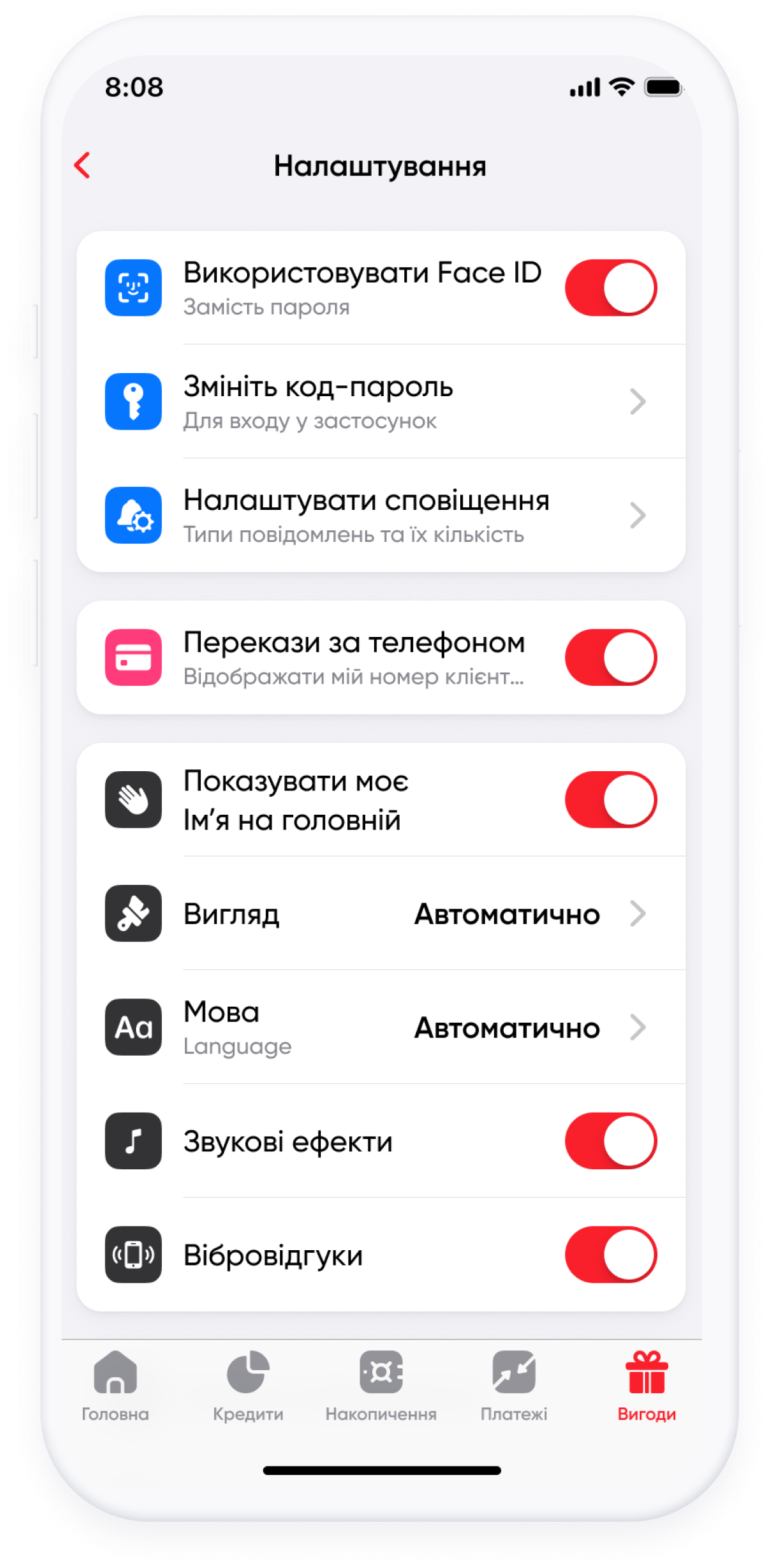

Mobile app

questions

complaint or suggestion

networks

Feedback