Dear Clients,

First Ukrainian International Bank (FUIB) has already fulfilled the requirements of the Law No. 533-IX concerning the loans to individuals and will not apply penalties from March 1 till April 30, 2020 and increased interest rates for those clients who will not be able to repay their loan payments on time from March 1 till May 31, 2020. However, we understand that this is not enough. In order to support our clients who have thoroughly repaid the loan but lost or partially lost this opportunity with the introduction of quarantine, FUIB has developed a 3-month loan repayment holidays program that will help reduce the financial burden of the repayment and avoid delays.

Loan repayment holidays apply to loans that were properly serviced by borrowers before March 1, 2020, and to all credit cards. IMPORTANT! Loan repayment holidays do not involve raising the real interest rate and paying a commission for providing them.

Who can use the loan repayment holidays:

- Clients who use FUIB credit cards

- Clients who have a valid cash loan

- Clients who have a valid credit for the purchase of goods

TERMS AND CONDITIONS OF LOAN REPAYMEN HOLIDAYS FOR FUIB CREDIT CARD HOLDERS

- Loan repayment holidays are automatically implemented and effective for all FUIB credit card holders whose payment dates are between March 30 and June 30, 2020. You DO NOT NEED to file applications or call the call center to activate loan repayment holidays for FUIB's credit cards

- Mandatory credit card payments accrued by the bank from February 29 to May 30, 2020, which previously consisted of the body of the loan and accrued interest, will only contain interest on the loan within the duration of the credit vacation. Repayment on the body of the loan is deferred for the duration of the credit vacation. This will allow to reduce the financial burden by twofold.

- Clients will pay reduced credit card payments between March 30, 2020 and June 30, 2020.

- Payments on the body of the loan that have not been paid temporally during the loan repayment holidays will have to be paid later. These payments will be evenly distributed and included in payments after the end of the loan repayment holidays in order to mildly bring the client to the previous schedule and amount of payments.

- Customers who do not require loan repayment holidays can, without restriction, pay amounts greater than the mandatory payment during the holidays (which at this time consists only of interest payments), including for the purpose of using the terms of the grace period. You can see the amounts of the mandatory payment, full repayment or grace period in PUMB Online

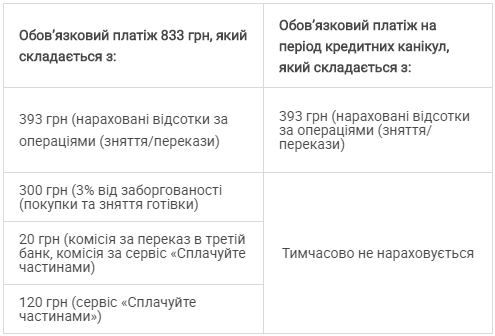

EXAMPLE for conditional mandatory credit card payment of 833 UAH

CONDITIONS OF LOAN REPAYMENT HOLIDAYS FOR HOLDERS OF CASH LOANS AND COMMODITY LOANS FROM FUIB

Starting on March 30, payments will only be formed only from the interest accrued. If the client has no debts on the amount of accrued interest (debts within the grace period), the obligatory payment will not be temporarily charged.

The exact date of the launch of the loan repayment holidays program for clients who have a valid cash loan or loan for the purchase of equipment from FUIB will be announced shortly.

Conditions of the loan repayment holidays:

- In order to use loan repayment holidays, there is no need to go to a branch. For holders of cash or commodity loans from FUIB, it is enough to remotely apply to the bank with corresponding initiative. You can do this by filling out an online form on the bank's website

- Mandatory payments according to the current schedule, which usually consist of the body of the loan and the accrued interest, will only contain interest on the loan during loan repayment holidays. Repayment on the body of the loan is deferred for the duration of the credit vacation. This will reduce the financial burden from March 30 to June 30, 2020 by about TWOFOLD.

- The terms of the holidays is 3 months, clients will pay reduced payments in the next three repayment periods (the next three payment dates under the Contract).

- Payments on the body of the loan that have not been accrued during the loan repayment holidays will have to be paid later. These payments will be evenly spread over the number of months remaining until the loan is fully repaid under the terms of the loan agreement.

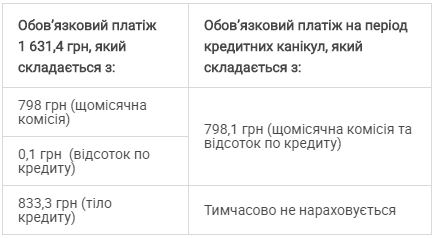

EXAMPLE for conditional mandatory loan repayment of 1,631.4 UAH

Additionally

For the period from April 1 till June 30, 2020, FUIB cancels commissions for repayment of loans through its own self-service equipment and self-service terminals of PrivatBank, IBox, EasyPay*, City24 and Sistema**. Crediting funds from the specified self-service equipment is done online and at no extra cost..

. *Crediting funds from any of the specified self-service equipment is done online

** Crediting funds from City24 and Sistema self-service equipment will be carried out the next business day after the date of payment.

- Кешбеки від ПУМБ у продуктових магазинах Польщі та Німеччині

- ПУМБ виступив фінансовим партнером 17-го Українського маркетинг-форуму

- «Жити назустріч»: ПУМБ спільно з партнерами створив лінійку адаптивного одягу для поранених військових

- ПУМБ знизив комісію за зняття готівки за кордоном

- Шановні клієнти!

- Біговий клуб PUMB RUN взяв участь у Київському півмарафоні незламності

Отримати на e-mail

Новину відправлено

Перевірте e-mail Дякуємо за Вашу цікавість!

questions

complaint or suggestion

networks

Feedback